In a previous post, I reviewed how to calculate how much you need to save to retire.

There were clear limitations to those methods. One used a lot of math and was overly sensitive to assumed future return rates. Another method relied on the 4% withdrawal “rule” which may no longer apply in our low-interest-rate environment.

Indeed, we may need to focus on a 2.5% – 3% withdrawal rate instead.

Retirement experts, Wade Pfau, Joe Tomlinson, and Steve Vernon, in conjunction with the Stanford Center on Longevity, have recently developed a different methodology for “safe spending” during retirement: “Viability of the Spend Safely in Retirement Strategy” or SSiRS (2019). This is a follow-up to their previous paper on this topic, “Optimizing Retirement Income by Integrating Retirement Plans, IRAs, and Home Equity” (2017).

We all know the story: pensions have been replaced by 401Ks and other contributory plans. We still have Social Security, but we need something like the pension that generates a consistent income payment for life.

Most of us need an easy strategy that we can implement with our current 401K (or 403b or 457) plus IRAs.

Without a lot of math.

Indeed, this strategy can be implemented without the help of a financial planner. (Although having one is always preferred.)

The SSiRS is intended for those of us in a middle-income bracket: from 100K to 1 million saved at the time we retire.

Step 1—Start with Social Security

Why middle income? The core of this strategy uses Social Security. For those of us in higher-income brackets, Social Security won’t be much help. (And we can afford a financial planner.)

And for those of us in lower-income brackets, Social Security may replace most of our needed income anyway.

For the middle-income group, from two-thirds to 80% of your income can be replaced by Social Security, according to the authors.

I find this estimate quite high, as it doesn’t match the numbers put out by the Social Security Trustees, where those of middle to high income retiring at their normal retirement age of 67 may see only a third to a half their income replaced.

As the authors remind us, Social Security has some clear advantages:

- You get paid for life, regardless of how long you live

- Your payment is not affected by the ups and downs of either the market or interest rates

- Your payment will go up with the cost of living

- Part of your payment is exempt from taxes

- Your payment will go to you automatically. When you start to cognitively decline you will still get your direct deposit.

(Is your payment guaranteed? I go into further detail on what happens if the Social Security trusts become insolvent. Short answer: at worst, you’ll lose 20% of your benefits. But that’s unlikely.)

In order to fully optimize social security, the authors recommend that you hold out claiming social security until age 70. This is significant as you get 8% more per year, past your full retirement age of 67. Three years (age 70-67) times 8% equals 24% more!!

[flip your phone sideways for easier viewing]

Claiming Social Security before full retirement results in a loss of benefits moving forward. In contrast, holding out past age 67 results in significant benefit gains. (There is no additional benefit by holding out past age 70.)

Obviously, this will increase the percentage of pre-retirement income that Social Security can replace and may explain why the authors had such generous numbers.

Step 2—Apply Required Minimum Distributions (RMDs) to your savings

Part of your income needs are covered by Social Security, but what about the rest? You’ll need to draw down the savings sitting in your 401K, etc.

But drawing down your savings is not something you want to “wing”. You want it to last your expected lifetime.

It was from this uncertainty that the 4% rule was originally developed. The same 4% rule that is now being called into question by some of the same authors.

The SSiRS does not use a fixed percentage withdrawal method. Instead, it bases your withdrawal on Required Minimum Distributions (RMDs).

Once you hit age 72 you are required the following year to start taking RMDs. The IRS wants their taxes, preferably before you die.

RMDs are based on how long the IRS thinks you are going to live. If it’s another 30 years, then the IRS wants you to take a distribution of one-thirtieth of all your tax-advantaged accounts. (With the exception of your Roth IRA and HSA.)

You don’t have to spend that distribution. You simply must take it out and pay the taxes. You can reinvest it in your taxable brokerage account if you like.

RMDs are an easy way to take a distribution that is intended to last your lifetime. However, keep in mind there’s a fifty percent chance that either you or your spouse (or both) will outlive the IRS estimates.

Unless you have a spouse more than ten years younger, most of us will use the Uniform Lifetime Table.

[flip your phone sideways for easier viewing]

| Age | Distribution period, years | Percentage withdrawal (1 / distribution period) |

| 70 | 27.4 | 3.6% |

| 71 | 26.5 | 3.8% |

| 72 | 25.6 | 3.9% |

| 73 | 24.7 | 4.0% |

| 74 | 23.8 | 4.2% |

| 75 | 22.9 | 4.4% |

Uniform Lifetime Table for calculating RMDs. Full table continues to age “115 and over”. From IRS.gov. (Note, tables have not been updated to reflect the new RMD age requirement of 72.)

- For example, you are age 74 and had 500K in your 401K at the end of last year. This year, you must take a distribution of $21,009 (500K / 23.8).

You are required to take an RMD from each individual 401K or 403b account. IRAs may be treated in aggregate; you only need to take an RMD from one account as long as it covers the required amount for the rest.

The financial institutions where you keep these accounts are very adept at RMDs. Simply set it up once and money will be direct deposited wherever you like.

They’ll even take taxes out if you wish.

Keeping your life savings in a Qualified Retirement Plan, such as a 401K, is ideal as you’ll enjoy extra protection provided by the Employee Retirement Income Security Act (ERISA). Creditors and litigators can’t touch it.

Note that mathematically, the inverse of the distribution period is a percentage. In this case, starting at 3.6% and getting bigger over time.

This is your withdrawal percentage. Instead of being fixed (eg, “4%”) it increases over time.

The percentage withdrawal is increasing, but depending on your rate of return, your total savings may be decreasing.

Pfau, et al. modeled how your income may change over time using RMDs. If you invest conservatively, and/or the market is poor, your yearly income will gradually decrease over time. In contrast, if you invest this savings aggressively, with mostly stock, your yearly income may gradually increase over time, then decrease later in retirement.

In this simplified version of the model:

- Start Social Security at age 70

- Start RMDs at the required age—currently 72

Photo by Immortal shots from Pexels

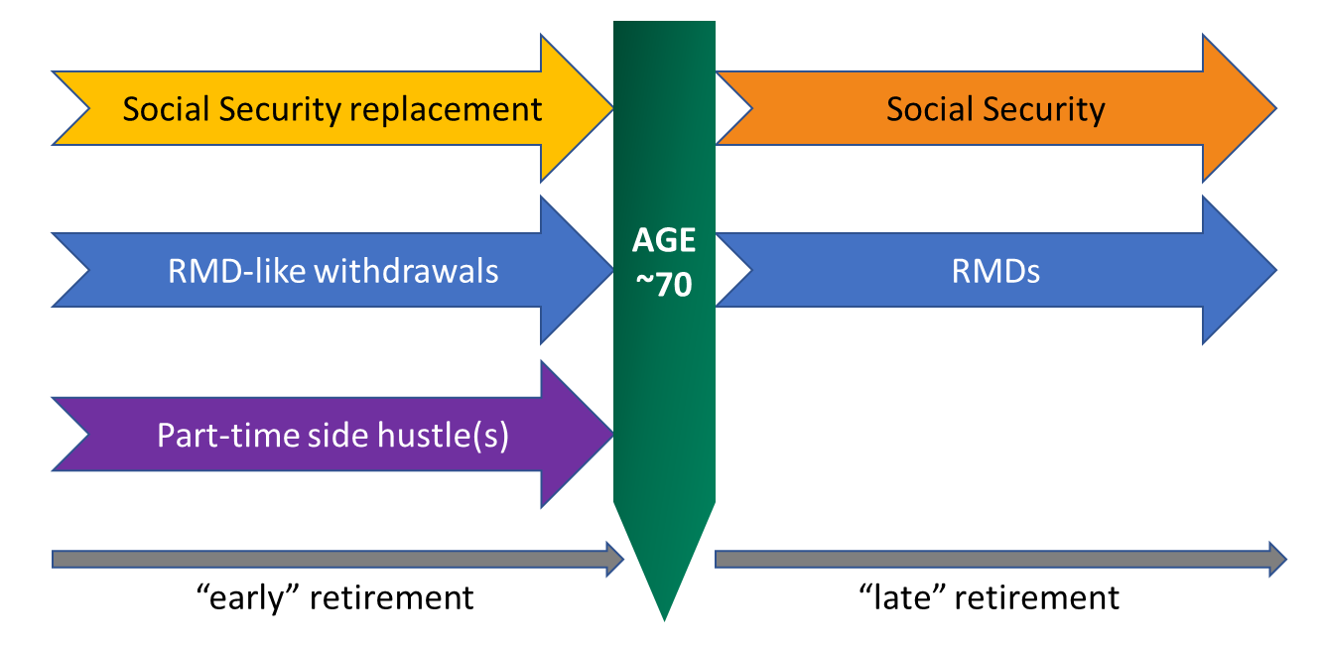

Retiring before age 70

Let’s be realistic unless you love your job, you’ll want to retire before age 70.

Perhaps you wish to leave the rat-race at age 62.

- Ideally, you could maintain a part-time gig or other streams of income

In addition, you’ll need to set aside two additional buckets of money within your savings portfolio.

- A Social Security replacement fund

This is to artificially create the income that you won’t get until age 70. You may either base this on what you expect to get at age 70, or a smaller payment that you would get if you started Social Security at age 62 or 65, for example.

This stash of money will be invested conservatively: money market funds, CD ladder, treasuries, ultra-short bond fund, etc.

For example, perhaps you expect $28,000 annually from Social Security starting at age 70. At 62, you’ll need to cover eight years. Set aside a stash of $224K (28K x 8). (Note, we’re assuming the small rate of return will cover inflation.)

Obviously, if you have a side gig, you may not need additional income. But if you do:

- Take “required minimum distributions” of your remaining savings

These aren’t real RMDs, as there is no minimum requirement prior to age 72, but it’s an easy way to follow the same withdrawal strategy.

When you calculate RMDs don’t forget to subtract the amount you set aside above for the Social Security replacement fund. If you have 500K and have set aside $224K, apply RMD math only to 276K.

The Uniform Lifetime Table starts at age 70, but the IRS has provided a few other tables which are intended for those taking RMDs from inherited tax-advantaged accounts. Take your pick.

- Single Life Expectancy Table, for those single

- Joint Life and Last Survivor, for couples with >10 years age difference

- Uniform Life Table, modified to include younger ages

The last table is not one provided by the IRS but instead generated by Pfau, et al. From age 70 and on it’s identical to the Uniform Life Table provided by the IRS.

Note how the withdrawal rates start off at around 2.7%.

[flip your phone sideways for easier viewing]

Age | Distribution period, | Percentage withdrawal |

60 | 36.8 | 2.7% |

61 | 35.8 | 2.8% |

62 | 34.9 | 2.9% |

63 | 33.9 | 2.9% |

64 | 33 | 3.0% |

65 | 32 | 3.1% |

Adapted from Pfau, et al. Values rounded.

Compared to the life table above, the Single Life Expectancy assumes you have fewer years left. As a result, your RMD will be higher. This scenario wasn’t tested by our authors, so beware.

This is what the SSiRS looks like:

[flip your phone sideways for easier viewing]

Chart by author, based on the SSiRS by Pfau, et al.

Separating different buckets of savings

What does it mean to “set aside” money for one purpose or another?

If you have an old 401K from an old employer that happens to be about the right size of the required Social Security replacement fund, then keeping track will be easy.

Most likely, you have one giant 401K. Then set aside the required amount using the available “money market fund” and invest the rest in the stock market (eg, an S&P500 index fund).

Don’t forget to turn off automatic rebalancing.

Another option is to rollover the amount needed for the Social Security replacement fund into a separate IRA account. Depending on which financial institution you choose, you will have far more investment options than your 401K: CDs, treasuries, ultra-short-term bond ETFs, etc.

Does the SSiRS work?

The authors ran models comparing this strategy to 292 other strategies. Some of the other strategies included combinations of the following:

- Social Security start date at either age 65 or age 70

- Fixed single premium immediate annuity (SPIA) for all savings

- SPIA with annual inflation adjustment of 3% per year

- Systematic withdrawals of 3%, 5%, and 7%

- Asset allocations of 0%, 25%, 50%, 75%, and 100% stock

- Partial annuitization, with 30% of savings placed in an annuity and the rest withdrawn using the various options above

Note: in all their models retirement starts at age 65. I look forward to additional data assessing earlier retirement dates, such as ag 62 or earlier. For earlier dates, more years are spent retired, so the results may not hold up.

The ideal strategy needed to meet two goals:

- Have an optimal income throughout retirement

- Have an optimal amount of savings left over

Although not exact, the latter goal correlates with a lower risk of running out. (Bonus if there’s money left over for your loved ones.)

Math logic dictates that if income is higher, then money leftover is less and vice versa. The objective is to find the best balance between the two. The authors created stochastic maps that visually showed this balance.

In addition, they also modeled different fictional retirees with different health statuses. The healthy retiree would need income for a longer period than the retiree in poor health.

The SSiRS strategy demonstrated the best balance between income and lifetime wealth (money left over)

The results were consistent, regardless of health status, or whether Social Security was started at age 65 or 70.

One important caveat: the optimal strategy was invested 100% in stocks.

This may be a bit scary for a retiree, but keep in mind that social security in these scenarios is making up the bulk of income.

Add an annuity

The partial annuitization strategy also performed well. This strategy took 30% of savings and placed it in an annuity with a guaranteed lifetime payment. The remaining 70% was invested in the stock market.

If your Social Security payment isn’t enough to cover necessities (utilities, healthcare, groceries, repairs, transportation) consider making up the difference with an annuity.

Because basic living expenses have been covered, you can afford to aggressively invest your remaining savings in the stock market. Use the RMD rules to make withdrawals.

In good market years, you’ll have extra money for travel or a kitchen renovation. In bad market years, you keep your extra spending to a minimum.

Tweak your plan

Tweaks are allowed. Perhaps you wish to travel the world during your first few years of retirement? Then set aside an extra “travel fund”. Just make sure you have enough savings remaining to cover the rest of the plan.

Are you concerned about health expenses or nursing home care during the last few years of retirement (the last few years of your life)? Again, you can set aside a separate “fund” invested conservatively.

What about Roth IRAs?

After age 72, RMDs are required of Roth accounts within 401Ks and other Qualified Plans. They are not required of Roth IRAs.

If you don’t need the income, simply leave your Roth IRA alone. If you need extra income you can apply the RMD formula to your Roth account as well.

Depending on your tax situation, you can also leave the Roth alone and take more from your traditional accounts. Or a combination. As long as you take the minimum required from your traditional accounts.

Hold off…

Perhaps your savings is generous. Or, because of a planned aggressive stock-heavy investment plan, you anticipate your savings will be generous.

If you anticipate that your post-72 RMD may be more than you need to cover expenses, then hold off using your Roth. Instead, draw down your non-Roth tax-advantaged funds during early retirement.

In the meantime, you may wish to use your Roth to keep you out of the next higher tax bracket.

…Or use your Roth

Alternatively, perhaps you are planning to spend heavily during your early retirement on travel and fun hobbies. You expect to spend your late retirement sitting around and watching Disney Plus. (Or whatever our media has evolved into…)

Remember that your social security replacement during early retirement will be taxed, but actual social security may not. At most, only 85% will be subject to taxes, and that’s for those of you with higher income.

As such, you may be in a higher tax bracket early and a lower tax bracket later. Drawing down a larger percentage of your Roth early may be better.

Unlike the SSiRS itself, you may need the advice of a financial planner or tax specialist to figure out the best strategy for drawing down your Roth.

Photo by Scott Webb from Pexels

Roth maintenance considerations

You may also find yourself in a situation where your current year’s taxes are low. Perhaps you are living off money in a taxable account with little dividends or interest. In that case, take this opportunity to Roth convert a chunk of your traditional money.

If your 401K doesn’t support Roth accounts, then you can rollover the money to a Roth IRA and pay the taxes.

Also, if you get close to age 72 and most of your Roth money is still in a Roth account with your 401K, you may want to rollover part or all of it to a Roth IRA to avoid RMDs.

Having a significant portion of your savings in a Roth IRA gives you options.

An example of the SSiR strategy

Perhaps you are a single woman who wishes to leave the workforce at age 65 with $800,000 dollars saved. Your pre-retirement income is $50K a year.

Should you take Social Security now or wait until age 67 or age 70?

[flip your phone sideways for easier viewing]

| Option 1: | Option 2: | Option 3: |

SS payment, today’s $ | $19,000 | $21,800 | $27,000 |

SS replacement added? | NA | Age 65 – 66 | Age 65 – 69 |

SS replacement fund size | NA | $43,600 | $135,000 |

Remaining savings for RMDs (800K – SS replacement) | $800,000 | $756,400 | $665,000 |

RMD payment, age 65 (savings / 32) | $25,000 | $23,640 | $20,780 |

Total income | $44,000 | $45,440 | $47,780 |

Replacement ratio (total / 50K) | 88% | 91% | 96% |

Social security (SS) estimate for age 67 is roughly based on the Table from SSA.gov; reduced by 13% for age 65 and increased by 24% for age 70

First, determine how much social security you’ll get at a given age. If you’re waiting, you’ll need to create a social security replacement fund to last until you take Social Security at either age 67 or age 70.

Multiply the number of needed years, by the annual expected social security income. That is your SS replacement fund.

Next, subtract the amount you set aside for your SS replacement fund from your total retirement savings.

Then divide your remaining savings by your distribution period. For age 65, divide by 32. This amount is your RMD.

Add your RMD to your social security payment. (This latter payment is either a real payment or from your SS replacement fund.) The total is your income for the first year at age 65.

How does this income compare to your pre-retirement income of 50K? Divide the first by the second to get your replacement ratio.

The replacement ratio is how much of your pre-retirement income has been replaced during retirement. Many expenses you had while working will go away: a mortgage, work clothes, commuting, regular savings, and payroll taxes. Other expenses may increase during retirement, including travel, hobbies, and healthcare.

Depending on your lifestyle choices, you may require a replacement ratio of anywhere from 80% – 120%

In this example, you are better off waiting until age 70 to take Social Security. Even when you set aside savings to replace Social Security income for the early years, your total income is greater.

By waiting you can replace 96% of your pre-retirement income of $50,000. In contrast, taking social security earlier results in only an 88% replacement ratio.

In all cases, you are leaving the workforce at age 65. You are simply deciding when to start Social Security and adjusting your savings accordingly.

Don’t have 800K? Another option is to add in a reverse mortgage.

A second SSiRS example with less savings

Yes, what if you don’t have 800K. What happens to the math when you are scraping by, say with only 300K saved?

| Option 1: | Option 2: | Option 3: |

SS payment, today’s $ | $19,000 | $21,800 | $27,000 |

SS replacement added? | NA | Age 65 – 66 | Age 65 – 69 |

SS replacement fund size | NA | $43,600 | $135,000 |

Remaining savings for RMDs (300K – SS replacement) | $300,000 | $256,400 | $165,000 |

RMD payment, age 65 (savings / 32) | $9375 | $8013 | $5156 |

Total income | $28,375 | $29,813 | $37,312 |

Replacement ratio (total / 50K) | 57% | 60% | 74% |

Obviously, you have less money to work with. A lifestyle reduction may be in order.

But regardless, holding out for Social Security at age 70 is still the best strategy. At a minimum, you need enough saved for the social security replacement fund.

More than 800K? If you have more savings than you need to replace your income, until age 72 you can always withdraw less than an RMD. If you can get a significant portion of your wealth into a Roth IRA, you won’t have to worry about the real RMDs either.

Unlike the rest of us, you won’t need to be in 100% stock to optimize your returns. You can keep a larger portion in more conservative investments.

A simplified tax example, with and without Roth money

This year our retiree in the above example is withdrawing $47,800 from tax-advantaged accounts (first example, option 3).

Perhaps 50% of the accounts are Roth and 50% are traditional. How much should you take from the Roth?

All money withdrawn from a traditional account will be taxed as ordinary income.

(For simplicity’s sake we’re ignoring any capital gains or qualified dividends from your taxable account. Ordinary income only. Also, payroll taxes are being ignored.)

Below are a few scenarios:

- Withdraw 100% from your traditional account and pay the maximum taxes

- Split it 50:50, consistent with your percentage of Roth vs traditional

- Pay with the traditional but add just enough Roth to escape the next higher tax bracket

On the far left, for comparison, are your taxes while still working.

While working you’re saving, right? Perhaps 5% to your Roth Account and 5% traditional. The latter is a deduction, so you get to subtract that when calculating AGI in the “still working” column.

[flip your phone sideways for easier viewing]

| Still working | Withdraw 100% from traditional | Withdraw 50:50 | Just enough Roth to avoid the next tax bracket | |

| Actual income | $50,000 | $47,800 | $47,800 | $47,800 |

| Gross income (minus Roth) | $50,000 | $47,800 | $23,900 | $23,199 |

| Deduction ($ → 401K) | $2,500 | NA | NA | NA |

| Adjusted gross income (AGI) (Gross minus deduction) | $47,500 | $47,800 | $23,900 | $23,199 |

| Standard deduction | $12,200 | $13,500 | $13,500 | $13,500 |

| Taxable income (AGI minus standard deduction) | $35,300 | $34,300 | $10,400 | $9699 |

| Taxes owed* | $4049 | $3929 | $1,061 | $971 |

| Net income (after taxes) | $40,951 (plus 5K → 401K) | $43,871 | $46,739 | $46,829 |

| Highest tax bracket | 12% | 12% | 12% | 10% |

| Taxes as percentage of actual income | 8.0% | 8.2% | 2.2% | 2.0% |

*Taxes based on 2018 tax tables available from IRS.gov. Tax brackets, however, are based on 2019 limits.

Gross income is your income after subtracting excluded income, which in this case is all the Roth income.

Your standard deduction (2019) for a single female is $12,200, plus another $1300 for being over age 65.

Before retiring you were probably paying around $4000 in taxes. You pay about the same once retired using exclusively traditional money.

By replacing half your income with Roth income, you reduce your taxes by almost 75% in this example.

You can further reduce your taxes by avoiding the next tax bracket. To calculate this, add your standard (or itemized) deduction of $13,500 to the maximum cut-off amount for the bracket you wish to stay in. In this case, the 10% tax bracket cut-off of $9699 (for 2019). Pay this amount with traditional, the rest with Roth.

If your taxable income is from zero to up to $9700 you pay 10% in taxes. For income from $9700 to up to $39,475 you pay 12% in taxes.

In this last scenario, we stay firmly in the 10% tax bracket.

Although the tax difference isn’t much between the last two columns in our example, it may be if you are sitting between the 24% and 32% brackets!

Keep in mind, this example doesn’t cover the potential tax savings on decades of Roth earnings withdrawn in late retirement, rather than early retirement. That could more than offset the additional tax spending now.

Obviously, this is a very simple example. Your mileage will vary.

Pros and Cons of the SSiRS

No strategy is perfect. Only you can decide if it works for you.

Good luck.

Pros

♦ Easy to implement. Little math required.

♦ Use your existing 401Ks, 403(b)s, etc. which are protected by ERISA and the fiduciary obligations of your employer-sponsored plan

♦ Optimizes Social Security, a guaranteed inflation-adjusted income stream for life

♦ RMDs annually adjust in response to your total savings balance, thereby accommodating changes in the market. This may help extend your savings and reduce the risk of running out.

♦ Unlike an annuity, you maintain full control of your savings. In case of death or divorce, funds can be redeployed.

♦ In later years, all payments are automatically calculated and direct deposited to your bank account. No worries, if you start to experience cognitive decline.

Cons

♦ Optimized results required 100% of savings to be invested in the stock market

♦ Annual income will vary. (However, if Social Security isn’t enough to cover basic living expenses, an annuity can be added.)

♦ If you haven’t saved enough, then most of your savings may be allocated to the Social Security Transition fund, with little left for RMDs (or growth)

♦ As the Social Security transition fund must be invested conservatively, potential growth will be missed. Likewise, those funds are not available for other financial goals or expenses.

♦ Social Security is not completely guaranteed. The trusts will become insolvent in 2035 unless Congress acts.

♦ Prior to age 72, your financial institutions may not be equipped to calculate your RMD. You may need to do it manually. (Depending on your math and planning skills you may still need a financial advisor.)

♦ RMDs are calculated based on the lifespan of a population of people the same age as you. You may live longer. Social Security payments continue for life, but your savings won’t.

♦ Different income amounts may be required at different stages of retirement (eg, more for travel early or more for healthcare later). To some extent, this can be addressed.

Additional Reading

- How Much Money Do You Need to Retire Comfortably? How big is the stash, and how much do you need to save to get there?

Will Social Security Still Be There When We Need It? Most likely

Rollover Revisited: Why Sticking With a 401K May Be Better. Should you rollover your retirement savings to a new employer’s 401K or a rollover IRA?

Need More Money to Retire? Consider a Reverse Mortgage. One option to generate a guaranteed income stream for your remaining years

First photo credit: Tom Levold on Unsplash

This information has been provided for educational purposes only and should not be considered financial advice. Any opinions expressed are my own and may not be appropriate in all cases. All efforts have been made to provide accurate information; however, mistakes happen, and laws change; information may not be accurate at the time you read this. Links are included for reference but should not be considered an implied endorsement of these organizations or their products. Please seek out a licensed professional for current advice specific to your situation.

Liz Baker, PhD

I’m an authority on investing, retirement, and taxes. I love research and applying it to real-world problems. Together, let’s find our paths to financial freedom.