Are you counting down the years until you can leave your soul-crushing job?

The one with the useless boss? Or the one that requires you to work long hours, travel, or simply be available 24/7? Or, the one where you must endure a long commute every day in order to “be present” in the office?

But alas, your finances aren’t in good shape.

No doubt you felt the need to compensate for your painful employment by spending more: including meals out, a nicer home to relax in, and taking exotic vacations far far far away…

I could go on about how you need to save more and readjust your lifestyle, blah blah blah. But you already know that.

You’ve taken an inventory of all your savings accounts, including 401Ks, IRAs—past and present. Any from an old job you may have forgotten about? Unlikely.

If you’re 62, you can take Social Security early. But if you’re already struggling to make your current savings last, that’s not recommended.

A reverse mortgage of your home is an option. There are definite pros and cons that you should review. It can stretch your current savings, but it won’t be enough to live on exclusively.

The solution? Redefine “retirement.”

What does it mean to “retire”?

Back in the day, our parents and grandparents worked until age 60 or 65. Had a nice party, then went home, never to work again.

In fairness, they weren’t as healthy as we are now. They might live another ten, fifteen years tops. At age 65 they were TIRED.

Today, 65 is the new 35. As long as you aren’t disabled, there’s no reason you can’t continue to be active for another decade or more.

The Social Security Administration may consider age 67 your full retirement age. But that is a completely arbitrary label.

Will you have the endurance for long work hours and travel like you did in your 20-40’s? Ah, no.

But by the same token, are you ready to sit at home all day and watch TV? The Netflix catalog is not that big. At a certain point, you will grow bored. (Believe me.)

You can continue to work and earn an income. But on your terms.

Changing your relationship with “work”

Do you simply wish to retire because you hate your job?

That should be addressed first. Is it the type of work you do? Have you done it so long that it no longer challenges you?

Is it the corporate culture, politics, or the people you work with?

Is it the long hours? Mandatory travel, for overnight trips, or simply the daily commute to the office?

Is it the stress of unrealistic deadlines or teammates who don’t perform?

Are there far too many things outside of your control that will impact your success?

Are you simply not happy?

Just as you did in your twenties and thirties, hunting for a new job may be in order.

Perhaps it goes deeper than that. The “same” job at a new location may not fix the problem.

Do you need to consider a “lateral” move? A different job that utilizes your established skillsets.

Even a move “down” could be considered, if it reduces your hours, travel, and stress level. The extra money might not be worth it.

Sure, you might have to work for more years at a job that pays less. But if you enjoy that job, then you CAN work for more years.

Need a bigger change? If you are lucky enough to have some savings, you can go back to school and pivot to a completely new career. Or try your hand at starting your own business.

(Evidently, we’re all supposed to call ourselves “consultants” now.)

Your basic skillsets, such as project management, communications, and leadership, are all transferable.

Photo by Rob Lambert on Unsplash

Your second middle age

In his book, “Retirement Game-Changer: Strategies for a Healthy, Financially Secure, and Fulfilling Long Life” (2018), Steve Vernon expands on a term popularized by a few experts called the “second middle age”.

During your “first” middle age, you’re busy working hard at your career and raising a family.

But from your late forties to your late-sixties—your second middle age—you may be becoming less enamored with your current career choice.

When you were younger, and trying to establish yourself, you may have put up with an abusive boss, long hours, and other poor working conditions. Now, you have no tolerance for that.

Your kids are now grown up, so there’s less financial pressure to provide for others.

(Hopefully) you’re still active and healthy.

Your attitude has also changed. Unlike when you were younger, you don’t care what other people think. You don’t need to do what society expects of you, such as working a 9-5 job until age 65.

Perhaps (like me) you were a big materialist and had to have the latest and greatest shiny object. And you had to fly off and experience the most exciting destinations.

You can still do some of that. But is it as critical to your happiness as it once was?

At this stage, you may find yourself reevaluating what is truly important to you.

Now that the kids are out, does it make financial sense to keep your larger house?

What do you wish your lifestyle to look like moving forward? Is it worth giving up a few things in order to be happier?

In short, what can you do that will maintain your happiness, but still provide income to live on?

Initiating a transition

Depending on your income needs, you may need to keep your current job, while working on your transition on the down-low.

But if you’re lucky and have some savings, you can take a “mini-retirement” and work on your transition full-time.

“Retirement means improving your life by changing your work.” –Steve Vernon, FSA

During this mini-retirement, you should be “working”, at least part of the time. This isn’t your “real” retirement yet.

Part of that work will be researching, and part may be educating yourself in a new area.

First, decide what are your requirements for your next career?

- Work from home? (No travel?)

- Part-time hours? (Or simply flexible working hours?)

- Freedom to pursue projects important to you? (Be your own boss?)

- More (or less) social interaction with clients or peers

- New challenges in a rapidly evolving field?

- Or, a slower field, with an opportunity to master one area?

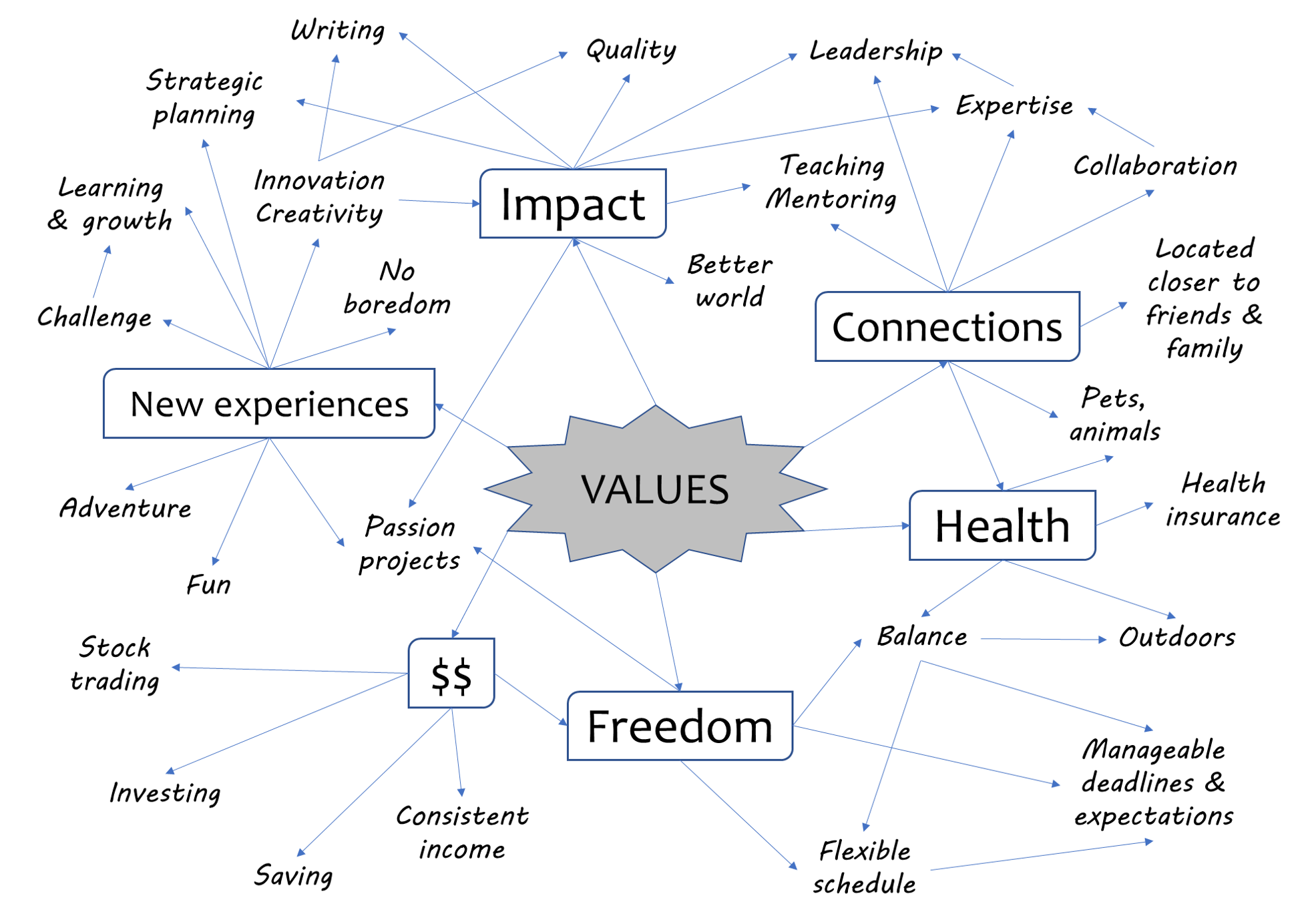

In her book, “Pivot: The Only Move That Matters Is Your Next One” (2017), Jenny Blake suggests several exercises. One is called a mind map, where you write out the values that are important to you, and how you would like them to manifest in your life.

Perhaps “service to others” is key for you. You feel proud when you can help others improve their lives.

- You could share knowledge as a teacher, writer, or mentor.

- You can improve their health and well-being as a nurse or other healthcare professional. (Indeed, any profession can be of service to others.)

- You could volunteer or contribute in other ways to causes that you feel passionate about.

Then draw arrows between values and the activities that support those values.

The more arrows you have around an area may indicate how important that area is to you.

You can use this mapping technique regardless of what stage of life you fine yourself. Whether you are contemplating a modest job change, a drastic career change, a post-retirement job transition, or even a complete retirement transition to a life of leisure.

This is an abbreviated version of my own map:

[flip your phone sideways for easier viewing]

My (simplified) mind map of my values and what each of these values looks like. What’s on your mind map?

What does it mean to be “successful”?

You’ve explored your values, favorite activities, and perhaps even prioritized them a bit.

One year from now what do you want your life to look like? What is your daily routine? Where are you living? Who are you surrounded by?

Jenny Blake recommends the “Give – Receive – Achieve” exercise:

- What impact do you wish to have on others? If you gave a TED talk that went viral what message would you send?

- What do you want to experience? What non-fiction books do you gravitate towards? What educational or experience-based YouTube videos do you watch?

- And what do you want to achieve? Picture yourself at an awards banquet in your honor. What are you being recognized for?

The more you get to know yourself, the more you’ll know whether a potential career or income opportunity is a good fit or not.

Research your dream life

First, you know a lot more than you think you know. Skills that you developed over the years are transferable to any other job or entrepreneurial endeavor.

Time management, project management, leadership, communication, collaboration, and organization are all skills you are probably very adept at. Even if you’ve been a stay-at-home parent for the last decade, you’ve still mastered these.

Start googling. In addition to knowledge of everything, the internet has networks of like-minded people researching the same areas, and at various stages of expertise. Join these groups and their message boards.

Flexibility is important at this stage. Maybe you had your heart set on moving into the exciting field of software development, but you’re finding it hard to pick up programming basics.

Perhaps instead, you could become a project manager at a software company and learn on the job.

Be prepared to pivot from your own ideas.

Likewise, maybe you start a new business venture but find it a struggle in the beginning. You probably need to keep going for a specified amount of time (only you can determine that). But it’s also useful to have a Plan B, a Plan C, and even a Plan D.

You can pursue these plans concurrently.

A diversified portfolio of income streams

Traditionally we had one job—one income stream—and if something happened, or we woke up one day and decided we hated it, there was no fallback.

You can keep your job. Just have a few backups.

Coaching, consulting, freelance work. Writing, vlogging, or selling your own goods or services.

Some of these side hustles may make a few bucks. Perhaps not as much as your day job.

But they may be enough to fund a second middle age, especially if you choose to leave your job and devote your full time to them.

Employers are slow to adapt

But what if you love your day job? Then, by god, you should keep it. Don’t’ leave until they carry you out on a stretcher.

Feel free to make some changes if needed. Reduce your travel and your hours. Discuss flexible working arrangements with management.

Prioritize your workload. Can you delegate to others? Or simply eliminate some of the low-priority low-importance busy work?

At some point, you’ll want to spend more time with family or pursuing hobbies, but you can choose the time that’s most feasible financially.

Employers are still slow to adapt. When layoffs happen, those fifty-five and above get the generous incentive packages to leave.

This is the perfect time to have a few side-hustles waiting in the wings.

On the downside, along with the youngest, it’s usually the oldest that are let go first. You may not be given a choice regarding your retirement date.

Have a plan B (and plan C, and plan D).

If your parents retired at age 65 or 62 or 60, don’t feel like you need to “beat them” by retiring earlier. Instead, beat them by living longer, and therefore enjoying a more fulfilling “post-rat-race” retirement.

Additional Reading

Need More Money to Retire? Consider a Reverse Mortgage. One option to generate a guaranteed income stream for your remaining years

Flex Work for All! An open letter to our Corporate Overlords on the benefits of the telecommuting and remote work style

- (Non-)Retirement in the Future. New trends in how we work will change how we retire

This information has been provided for educational purposes only and should not be considered financial advice. Any opinions expressed are my own and may not be appropriate in all cases. All efforts have been made to provide accurate information; however, mistakes happen, and laws change; information may not be accurate at the time you read this. Links are included for reference but should not be considered an implied endorsement of these organizations or their products. Please seek out a licensed professional for current advice specific to your situation.

Liz Baker, PhD

I’m an authority on investing, retirement, and taxes. I love research and applying it to real-world problems. Together, let’s find our paths to financial freedom.