2023 UPDATE

Contribution Limits for 2023

From IRS.gov

- IRA contribution of $6,500, with $1,000 catch-up

- 401K contribution of $22,500 with $7,500 catch-up

- SIMPLE contribution of $15,500 with $3,500 catch-up

TOTAL contribution for a defined contribution plan (like a 401K) of $66,000

- TOTAL includes contributions from employee, employer, and after-tax

- With catch-up contributions, the TOTAL becomes $73,5000

For more information see our TAX SAVINGS page

Your end-of-year financial checklist

Yes, I know, you’re not doing your taxes until the eleventh hour, in early April of next year. (Or even later for those who love filing extensions.) However, before you ring in the New Year there are a few items you should probably put in order first.

1. Maximize contributions to your 401K or other employer retirement plan

In 2020 you may contribute up to $19,500 to your 401K, or $26,000 if you’re age 50 and above.

Usually, you tell your employer to take a percentage out of your paycheck and hope you’ve done the math right. Now may be a good time to double-check the math.

At a minimum, contribute enough to get your employer match if they provide one. That’s free money. Or stated another way, a 100% return on the money you invest.

Ideally, you should go for the maximum limit of $19.5K.

If your employer allows it, you can even go above $19.5K by contributing after-tax dollars. As the name implies, these dollars are taxed first. Later you can convert this money to Roth dollars, either within your 401K plan (if allowed), or after you leave your current employer.

This is called the “Mega-Backdoor Roth”. Read more about it here:

Note, you still have a limit, which is $57,000, or $63,500 for the 50 and over set.

There are a couple of caveats. This limit includes everything both you and your employer contribute. So, if you have a generous employer you may be limited in how much of your own money you can contribute.

Most of us would not consider that a problem.

You also must make at least as much as you contribute. Any contribution to a retirement account, including IRAs, must be from “earned” income. For example, you can’t earn 36K, then contribute say, $50K, by taking the difference from your savings.

What if you did the math wrong and contributed too much?

If you have an “excess deferral” above this latter limit your 401K Plan administrator should have a process for getting the excess cash back to you. You have until April 15th of next year to remove the excess. If the excess doesn’t come out it will be effectively taxed twice, once before it went in, and later when it’s taken out.

2. Maximize contributions to your IRA

If we have an employer retirement plan most of us forget about our IRA. This is understandable as Roth IRA contributions are not allowed if your income is ≥ $139K (single, 2020) or ≥ $206K (married-filing-jointly or MFJ, 2020).

Likewise, if you are covered by an employer retirement plan you can’t take the tax deduction for a traditional IRA contribution if your income is ≥ $75K (single, 2020), or ≥ $124K (MFJ, 2020).

But you can always make a traditional IRA contribution, it just may not be deductible.

This is fine. You can always Roth convert that money at any time. This is called a “Backdoor Roth IRA”. More on that HERE as well.

Not ready to decide?

No problem, you have until your tax filing deadline of next year (not including extensions).

- For example, you don’t make an IRA contribution this year. In February of 2020, you contribute $12,000 to your IRA. $6,000 will count towards 2019, and the other $6,000 will count towards 2020.

As a reminder, the 2019 (and 2020) IRA limit is $6000, or $7000 for the 50 and older folks.

You’re unlikely to over-contribute to an IRA, but if you do, you have until your tax filing date next year (including extensions) to remove the excess. Otherwise, a 6% per year penalty will apply.

Don’t forget to also remove any earnings on the excess amount.

Photo by Lucy Heath on Unsplash

3. Do a Roth conversion

At this point, you may have a rough idea of your taxable income for this year and how much you may owe in taxes. If you are comfortable paying a bit more in taxes, consider Roth converting some of your traditional 401K savings (if the plan allows) or your traditional IRA money.

You may do a Roth conversion at any time; you simply need to pay the taxes.

If this was a “slow” year for you, and your income was lower than usual, this may be the optimal time to do a Roth conversion.

Perhaps you are newly retired and living off taxable savings. Perhaps you are taking a year (or more…) off. Perhaps you are self-employed but still getting things started.

Moreover, you still may have deductions you need to offset. At minimum, there’s the standard deduction of $12,400 (single, 2020) or $24,800 (MFJ, 2020). If you itemize, you may deduct even more. Common deductions include mortgage interest, state and local taxes (up to $10K), and charitable contributions.

- For example, perhaps you’re newly retired and living off taxable savings at present. You haven’t yet dipped into your large retirement IRA.

- You aren’t earning anything, and your only income comes from a few dividends, interest, and capital gains. Your adjusted gross income (AGI) is $20,000.

- However, you itemize and find you have $30K in deductions

- Some deductions will carry over and can be used in future years, but many deductions are “use it or lose it”. If your income is $20K, you can wipe that out with your deduction, but you have $10K in additional deductions that may go to waste.

- In this example, you can Roth convert 10K

- You’ll owe taxes on that Roth conversion, but those will be wiped out from your extra deductions

- In this example, you pay no taxes

As a reminder, Roth money grows tax-free and all earnings will never ever be taxed during your lifetime (assuming you follow the withdrawal rules). If you don’t anticipate using that savings for several more decades, that could be a significant return.

Ideally, you’ll want a balance of both Roth and traditional retirement savings.

Most of us have no idea if our tax bracket in retirement will be greater or less than our tax bracket today. With a balance of both, you can decide your tax bracket by choosing which account to take your distributions from during retirement.

4. Take any Required Minimum Distributions

Are you obligated to take Required Minimum Distributions (RMDs) on either your 401K retirement account or IRAs?

The IRS doesn’t want your money growing tax-free indefinitely. They would like their taxes, thank you very much.

If you turned 72 this year, you most likely will need to start. (This is a change from the 70½ age requirement for 2019 and earlier.) You have until April 1st of next year to take your first distribution.

If this isn’t your first RMD you only have until the end of this year to take a distribution (withdrawal).

Until you die, your Roth IRA will never require RMDs. You can let it grow unhindered. (Note, those rules don’t apply to the Roth account within your 401K. Once you stop working and are of the requisite age, the Roth account will be subject to RMDs.)

Also note, if you still happen to be working at age 72, you are not required to take RMDs from your current employer 401K.

However, any 401K accounts from past employers, plus all your traditional IRAs will be subject to RMDs. (Which is why it’s recommended to roll all that old traditional money into your current 401K if you’re allowed.)

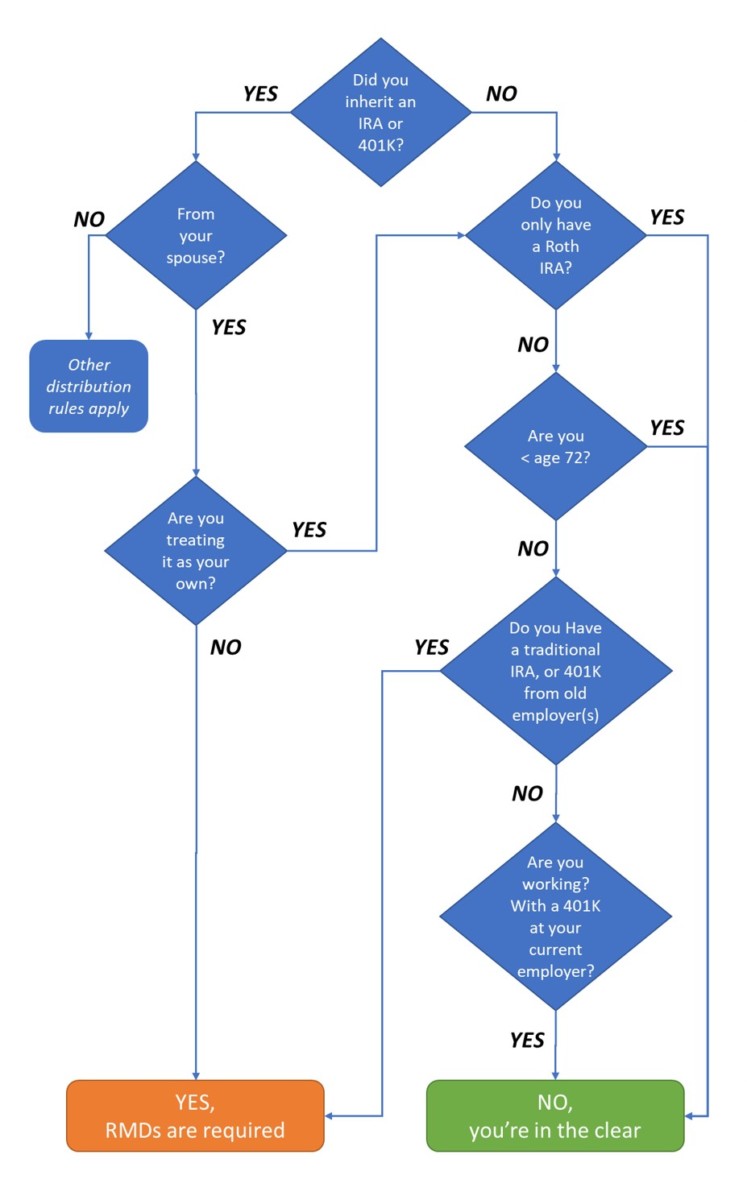

Here is a handy flowchart to check on whether you may be subject to RMDs.

Do you need to take RMDs this year?

Note that spouses can treat an inherited IRA or 401K as their own, but not non-spouses. For more information: https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-required-minimum-distributions

For more on RMDs and inherited IRAs, see my post HERE.

Don’t worry about calculating your RMDs as your financial institution will do that for you. In most cases, you can set up automatic withdrawals from your IRA to a regular taxable brokerage account or even your day-to-day checking account.

If you are taking RMDs, most likely you’ll owe taxes on those distributions. Except for withdrawals from Roth accounts and Roth IRAs, all distributions are taxed as regular income and subject to your usual tax bracket.

If you are subject to RMDs make sure you take them by the deadline. Otherwise, the IRS will impose a 50% penalty.

That’s right 50%!!!

5. Double-up (or triple-up) charitable contributions

After making all your savings goals, do you have money left over? Why not give to charity.

If you wish to get the tax deduction for this year, don’t forget to make your contribution before the end of this year.

You may have noticed that the standard deduction on your taxes is much higher than it used to be, as high as $24,800 (2020) for most couples. As a result, most of us probably won’t bother itemizing our deductions. (However, we still should if we have state taxes.)

Because charitable contributions count as an itemized deduction, you may not get any tax benefit if you simply take the standard deduction.

Of course, that’s not the reason you give, but the tax deduction is a nice perk.

To get the benefit of the deduction, consider doubling up (or tripling up) your charitable contributions this year. Itemize for this year.

Then next year (or the next two years), skip your charitable contributions and take the standard deduction instead.

- For example, perhaps you are a couple (MFJ) with an AGI of $200,000. Therefore, your top tax bracket is 24%.

- You contributed $20,000 this year to charity

- (To keep things simple) you have no other deductions.

- As the standard deduction is $24,400, or greater than your itemized deduction of $20,000, you’ll take the standard deduction

- But you aren’t getting any tax benefit for your charity

- What if you instead, donated $40,000, or even $60,000?

Here’s how these two strategies might stack up. Shown are the first six years.

Usual annual contribution to charity

| Annual charitable contribution | Taxable income* | Taxes owed (based on 2019 calculations) | |

| This year | $20,000 | $175,600 | $30,493 |

| …next year | $20,000 | $175,600 | $30,493 |

| …year three | $20,000 | $175,600 | $30,493 |

| …year four | $20,000 | $175,600 | $30,493 |

| …year five | $20,000 | $175,600 | $30,493 |

| …year six | $20,000 | $175,600 | $30,493 |

| Total over six years | $120,000 | $182,958 |

*Taxable income = $200K minus the charitable contribution OR $200K minus the $24,400 standard deduction; whichever is less.

For all six years, your top tax bracket is 24%.

Double-up charitable contributions this year

| Double-up | Taxable income* | Taxes owed (based on 2019 calculations) | |

| This year | $40,000 | $160,000 | $26,917 |

| …next year | 0 | $175,600 | $30,493 |

| …year three | $40,000 | $160,000 | $26,917 |

| …year four | 0 | $175,600 | $30,493 |

| …year five | $40,000 | $160,000 | $26,917 |

| …year six | 0 | $175,600 | $30,493 |

| Total over six years | $120,000 | $172,230 |

*Taxable income = $200K minus the charitable contribution OR $200K minus the $24,400 standard deduction; whichever is less.

In alternating years your top tax bracket has dropped to 22%.

Savings over six years, vs annual charity contributions: $10,728 (182,958 – 172,230)

Triple-up charitable contributions this year

| Triple-up | Taxable income | Taxes owed (based on 2019 calculations) |

This year | $60,000 | $140,000 | $22,517 |

…next year | 0 | $175,600 | $30,493 |

…year three | 0 | $175,600 | $30,493 |

…year four | $60,000 | $140,000 | $22,517 |

…year five | 0 | $175,600 | $30,493 |

…year six | 0 | $175,600 | $30,493 |

Total over six years | $120,000 |

| $167,006 |

*Taxable income = $200K minus the charitable contribution OR $200K minus the $24,400 standard deduction; whichever is less.

Every three years your top tax bracket has dropped to 22%.

Savings over six years, vs annual charity contributions: $15,952 (182,958 – 167,006)

Yes, in this scenario you could save as much as $15,952 in taxes over six years, which is approximately $2,650 annually.

Obviously, the math will vary with your situation, and from a practical standpoint, you may not have enough saved to do either a double-up or a triple-up. But it is a scenario to consider.

Also, if you wish to be very generous, there are limits on how much of your AGI you can deduct as a charitable contribution. Depending on the type of donation, the limit may be anywhere from 20% to 60% of your AGI. Be aware if you are doubling- or tripling-up.

Qualified Charitable Distribution (QCD)

If you are over 70½ you have an even better way to give to charity. Have your financial institution pay the charity directly from your IRA. It will count towards your RMD, and because it’s a gift to charity, this money won’t be taxed.

You don’t need to worry about itemizing it as above. You can continue to take the standard deduction and still get the tax benefit of the charitable contribution.

There is a limit of $100,000 in total contributions per person per year. (A couple can each contribute $100K from each of their own IRAs, or $200K total.)

6. Harvest tax losses

In other words, sell losing investments to offset this year’s winners. In your taxable investment account (not your IRA or your 401K) you may have had a good year and now have some capital gains to report on your taxes.

Did you know that capital gains can be offset by capital losses?

Are there any dogs in your portfolio, worth less than what you paid for them?

Now may be the time to sell the dogs, take the loss, and use that loss to offset the capital gains of the winners.

- For example, you sold ABC mutual fund and have a $10,000 long-term capital gain. At this point, you will owe taxes.

- Earlier this year you bought $30,000 worth of stock in THE NEXT BIG THING Inc. which turned out to NOT be the next big thing. It’s now worth $10,000.

- Sell your loser. You may sell part or all of it.

- Perhaps you sold half and realized a loss of $10,000 (($10,000-$30,000)/2)

- The $10,000 loss zeroes out your $10,000 gain. You owe no capital gains taxes.

Alternatively, you can sell your entire losing position. (Not a bad idea, as it’s not likely to recover.) That would leave you with $20,000 in losses. After applying $10K to the gain, you may deduct an additional $3,000 loss from your income. The remaining $7,000 loss can be carried over to next year.

Next year you can use that $7,000 to offset any capital gains.

However, if you continue to make bad investments (it happens to all of us…) you can slice off another $3,000 to deduct from your income and continue to carry over the loss balance. Indefinitely.

Once sold, don’t repurchase your losers back in January. If you buy back a losing security within thirty days, this is called a Wash Sale. The loss is disallowed for this year; instead, it’s added to the basis of the new lot you just purchased. You’ll effectively get the loss back, just not right away.

7. Confirm your health insurance

This is your annual reminder that this time of year is open enrollment. This applies to your employer-provided health insurance, health insurance sold on state exchanges, and Medicare.

Do you like your current plan, or do you wish to switch?

If you are ridiculously healthy you may wish to consider a High Deductible Health Plan (HDHP) which may either be available from your employer or through a state exchange.

An HDHP will allow you to set aside up to $3550 (in 2020) for yourself, or $7100 (in 2020) for your family, in a Health Savings Account (HSA). You may use these funds for any qualified medical expense.

It’s triple tax-advantaged: money goes in tax-free, grows tax-free, and comes out tax-free, as long as you use the funds for qualified medical expenses.

These expenses don’t need to occur in the same year you claim them. You can sit on receipts for years, even decades, letting your HSA balance grow first.

After you turn 65 you may also use the money in your HSA for non-medical expenses. However, that money is taxed, just as if it came out of your traditional IRA.

The downside of this plan is that deductibles are high. Did I mention you (and your entire family) need to be super healthy and have very few medical expenses at present?

For more on HSAs, see my post HERE.

8. Maximize contributions to your HSA

If you currently have an HSA, you have until the end of the year to maximize your contributions. For 2020, the limits are $3550 for individuals and $7,100 for families (2020).

9. Adjust your withholding

You don’t need to do this right now, but you should keep it in mind as you or your CPA finalize your taxes for the year.

Yes, we all like getting a tax refund from the government.

But technically you’re giving the government an interest-free loan on YOUR money.

Ideally, your refund should be very small or non-existent. Writing a check to the government is painful, but you get to keep the money—and any interest it earns—for as long as possible.

Payroll, where you work, will have a process for adjusting the amount of both federal and state taxes taken out of your paycheck.

The IRS provides a handy Tax Withholding Estimator tool:

For those of you who are self-employed, you are aware that you need to send in estimated taxes to the IRS quarterly.

What if your estimation is off?

When you file, if you owe less than $1000 in taxes or if you’ve already paid 90% of taxes owed, then you’re in the clear.

If you owe more, you may be subject to a penalty for underpayment of estimated taxes. Keep in mind this “penalty” is only the small amount of interest the government failed to earn on your underpaid taxes.

In my experience—assuming you’re close—the penalty is around $50.

So not something to lose sleep over.

10. Maximize your gifting

Tis the season to play Santa Claus. In addition to your charitable giving, you may also have individuals in your life that you wish to shower with gifts.

At present, you may give up to $15,000 per year to as many people as you like, without any tax consequences, for either you or them. If you are a couple, you may give up to $30,000.

Is your gift recipient planning to go to a college, university, or trade school in the future? Instead of giving them the money outright, you can instead deposit it into a 529 Account in their name. Now the gift can grow tax-free until it’s used for a Qualified Educational Expense.

For more on 529 plans, see my post HERE.

If you want to be really generous you can always go over the $15K per person limit. However, you will be cutting into your lifetime gift tax exclusion amount. (You’ll need to keep track, come tax time.)

This value is always changing, but at present, the lifetime exclusion is $11.4 million dollars. ($22.8 million per couple.)

In other words, you can give up to $11.4 million dollars, either during your lifetime or after death, without any tax consequences. (Obviously more, if you are giving to charity.)

Good luck!

Your Checklist

- Maximize contributions to your 401K or other employer retirement plan

- Maximize contributions to your IRA

- Do a Roth conversion

- Take any Required Minimum Distributions

- Double-up, or triple-up, charitable contributions

- Harvest tax losses

- Confirm your health insurance

- Maximize contributions to your HSA

- Adjust your withholding

- Maximize your gifting

Additional Reading

Maxed Out 401K? How to Add More Tax-advantaged Retirement Savings

Is Yoga Covered by my Health Savings Account? What About Sunglasses?

Capital Gains or Income? How are your investments taxed?

Before You Cash Out an Inherited IRA, Review Better Options. Tax rules and savings strategies for inherited traditional and Roth IRAs

Best Way to Save for Your Kid’s College? Contribute to a tax-advantaged 529 account

This information has been provided for educational purposes only and should not be considered financial advice. Any opinions expressed are my own and may not be appropriate in all cases. All efforts have been made to provide accurate information; however, mistakes happen, and laws change; information may not be accurate at the time you read this. Links are included for reference but should not be considered an implied endorsement of these organizations or their products. Please seek out a licensed professional for current advice specific to your situation.

Liz Baker, PhD

I’m an authority on investing, retirement, and taxes. I love research and applying it to real-world problems. Together, let’s find our paths to financial freedom.