Without giving away my age, let’s just say that when I was “younger” 1 million dollars sounded like a lot of money. And it was.

But thanks to inflation—even historically low inflation—that 1 million dollars is only worth around $400,000 today. In other words what 1 million could purchase “back then” will only purchase 400K today.

At present we’re all putting away money for our long-term goals: the kid’s college, a work “sabbatical”, or simply our retirement. (You’re putting money away for your retirement, right?)

These goals may be DECADES in the future. Which allows inflation plenty of time to do its damage.

One reason inflation is so insidious is that it compounds. Everything costs two percent more than it did last year. But next year it will be another two percent more, based on this year’s cost, which includes the two percent added from last year. And so on.

Historical Rates of Inflation

In the previous century, inflation rates were all over the place, ranging from negative ten percent to over twenty percent!

Fortunately, we will probably never see these kinds of swings ever again. One of the mandates of the Federal Reserve is to keep inflation in check. It’s important to maintain a balance to ensure stable economic growth.

The Federal Reserve’s favorite inflation rate is 2%

Indeed, inflation over the past few decades, in this century, have been quite low, averaging 2.18% since 2000. As of this writing, the current inflation rate is 1.8%.

Which inflation rate should you use for future calculations? Most of us use either 3% or 3.5%, which is related to the long-term historical average, dating back to 1914. The history that also included those wild swings mentioned above.

In the short-term, the next decade or so, 2.2 – 2.5% may be reasonable. For longer durations use 2.5 – 3.5% depending on how much you trust our Federal Reserve and how conservative you wish to be. The more conservative, the higher the number.

Calculating the effects of inflation on your savings

Mathematically, use the Future Value equation where “i” equals the inflation rate.

Time value of money

You can use your favorite annuity calculator, or simply use the handy table below.

The table provides an “inflation factor” which is equal to how much one dollar will inflate, based on three different rates of inflation. How much it will cost to purchase what one dollar purchases today.

To determine how much your savings will be worth in the future, divide it by the inflation factor.

For example, $100,000 in today’s dollars will only be worth $74,627 in ten years at 3% inflation. (100K divided by 1.34.)

Inflation factor

| Inflation rates | |||

| Years (from now) | 2.5% | 3.0% | 3.5% |

| 5 | 1.13 | 1.16 | 1.19 |

| 10 | 1.28 | 1.34 | 1.41 |

| 15 | 1.45 | 1.56 | 1.68 |

| 20 | 1.64 | 1.81 | 1.99 |

| 25 | 1.85 | 2.09 | 2.36 |

| 30 | 2.10 | 2.43 | 2.81 |

| 40 | 2.69 | 3.26 | 3.96 |

Divide today’s dollars by the inflation factor to get the buying power at different years from now.

When you hit around the twenty-year mark, everything is worth HALF of what it does today. Your 100K is only worth $50K.

At the higher inflation levels of 3% and 3.5%, you hit factors of three and even four.

At 3.5% inflation, in 40 years, your 100K will only be worth $25,000!!!

Ouch!

What to do about it? Earn more than the rate of inflation

The solution to this problem is simple: earn more than the rate of inflation.

If your return is around three percent, you’re breaking even.

If you’re making less than three percent, you are LOSING MONEY.

Stop.

Which is why financial planners always recommend placing at minimum a portion of your long-term savings in stock funds. Yes, they’re volatile, and some years they will be down a scary amount. But over the course of decades, they will outpace inflation, and then some.

But what about bonds?

Bond yields are tied to interest rates.

Remember the Federal Reserve? The adjustment of interest rates is one of their tools to maintain our stable economy and prevent inflation.

In the past, bond yields were respectable, sometimes even beating out the return of stocks. But in our low-interest-rate environment, they make very little.

Check that your bond allocation is beating inflation. You may need to switch to more generous corporate bonds.

Or if you have decades to go, consider ditching bonds altogether.

What about TIPS?

TIPS are Treasury Inflation-Protected Securities, designed to maintain their value with inflation. To compensate for this benefit, their yield is much less than a regular fixed-rate Treasury.

As we have been living in a low-interest-rate environment for quite some time, there has been little benefit to parking your money in TIPS. Indeed, even with inflation, you are probably making more with the Treasury.

Yes, TIPS correct for inflation but provide a very low overall rate of return.

Calculating the effects of inflation on your rate of return

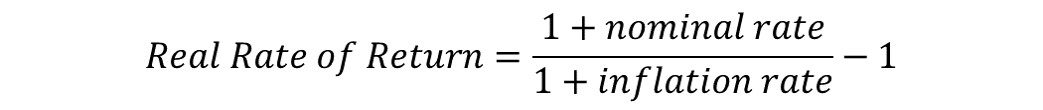

Let’s say your portfolio makes 9% on average. What is your “real” return rate, after inflation?

(You could subtract 3% from 9% and get 6%. That would be close, but not correct.)

This is the correct formula:

A 9% return with 3% inflation is an inflation-adjusted (“real”) return of 5.825%

An alternative approach to calculating how much your savings will be worth in the future is to use the inflation-adjusted rate of return. The result will be your total in “today’s dollars” with today’s purchasing power.

For example. Using the Future Value (FV) equation above:

- 100K in 20 years at 9% is $560,400 actual dollars

- 100K in 20 years at 5.825% is $310,300 in today’s dollars

- To check, $560,400 divided by an inflation factor of 1.81 equals $309,600

(Considering all the rounding errors in these simple examples, $310,300 is close enough to $309,600.)

Depending on what you are trying to calculate you may use either the inflation factor or the adjusted return rate. Your choice.

Image by Pixabay

One last caution, or two

Depending on what timeframe you review, the S&P500 has averaged around a 9% rate of return.

Don’t trust this number.

Stocks don’t behave like bonds. You don’t get a nice steady consistent 9% return. Instead, you’re up 20% one year, then down 5% then next, then up 7% the following year. Etc.

You could average the annual returns, generating an arithmetic mean, but that would not be correct.

Instead, make sure you are using the geometric mean, which is reflected in the CAGR or compound annual growth rate. The rate includes the effects of compounding, both up and down.

(More on that HERE.)

But even with the correct CAGR you still may have Sequence of Return Risk, when poor performance occurs early on, causing your portfolio to fall behind.

If you are still accumulating savings, then dollar-cost-averaging will solve this problem. You are buying more shares when the market is down, and the price per share is low. When the market is up, you are buying fewer shares. Over time, your average cost per share will be much less than the average price per share, even if the market has only broken-even to where you started.

Once you retire and are no longer adding to your stash, sequence of return becomes an issue. There are ways to mitigate this risk, but the point is that a 9% CAGR may not be your expected return.

As always, results will vary.

In summary, when doing the math, never forget about inflation.

You may either:

- Divide actual dollars by an inflation factor to get the value in “today’s dollars”, or

- Use an inflation-adjusted rate of return

Check out the Inflation Quick Reference Guide

Good luck!

Additional Reading

How Much Money Do You Need to Retire Comfortably? How big is the stash, and how much do you need to save to get there?

The Stock Market Doesn’t Make as Much as You Think it Does. Evaluating CAGR—compound annual growth rate—over the long term

Will You Run Out of Money? Closing in on retirement? How to manage your existing savings to last

First photo credit: Brett Sayles from Pexels

This information has been provided for educational purposes only and should not be considered financial advice. Any opinions expressed are my own and may not be appropriate in all cases. All efforts have been made to provide accurate information; however, mistakes happen, and laws change; information may not be accurate at the time you read this. Links are included for reference but should not be considered an implied endorsement of these organizations or their products. Please seek out a licensed professional for current advice specific to your situation.

Liz Baker, PhD

I’m an authority on investing, retirement, and taxes. I love research and applying it to real-world problems. Together, let’s find our paths to financial freedom.